Press Release, Enduro Drilling Intersects 17.15 g/t Gold, 26.20 g/t Silver, and 1.18% Copper Over 2.72 Metres; Evidence Mounting for a Large-Scale Gold System - 139 Metres of 0.82 g/t AuEq

Kelowna, British Columbia--(Newsfile Corp. - February 9, 2021) - Enduro Metals Corporation (TSXV: ENDR) (OTCQB: SIOCF) (FSE: SOG) ("Enduro Metals" or the "Company") is pleased to report drill assay results from another four diamond drill holes from the 17-hole program completed along the McLymont Fault during the 2020 exploration program at Newmont Lake. The McLymont Fault is 1 of 4 major systems within the Company's 638 square kilometre Newmont Lake Project situated in the heart of BC's prolific Golden Triangle.

Highlights:

All four drill holes intersected shallow high-grade gold including 2.72m of 17.15 g/t gold, 26.19 g/t silver, and 1.18% copper in our first drill hole of 2020. More grades as high as 54.59 g/t gold, 135 g/t silver, and 1.18% copper over 0.50m in step-outs.

Three of four drill holes also intersected longer intervals of lower-grade, bulk tonnage gold. NW20-04 intersected 138.6m of 0.82 g/t AuEq ("Gold Equivalent"), including 33.6m of 2.47 g/t AuEq starting at 119.83m depth. The drill hole ended in gold mineralization and remains open.

Discovery of the strongest gold - copper geochemical anomaly at Newmont Lake to date along trend of current high-grade gold drilling. The discovery is concurrent with a large ZTEM geophysical anomaly.

Mounting evidence of a large-scale, gold-copper porphyry system along the McLymont Fault - potentially the ultimate source of the shallow gold and copper mineralization drilled to date.

Drill Results:

The first four holes of the program were designed to expand the footprint and increase the amount of known gold mineralization within the footprint first established by 1980's drilling along the McLymont Fault - a regional structure now recognized as an important conduit for gold mineralization.

Figure 1: Long section looking west-northwest at the McLymont Fault. The first horizon of high-grade gold mineralization remains open along strike. The second high-grade horizon is beginning to develop. Lower-grade porphyry-like gold mineralization is developing in multiple drill holes suggesting there is a system in the vicinity.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6406/74016_a3de70abe4aba87e_002full.jpg

NW20-01 (-85°/300°) intersected 17.15 g/t gold, 26.19 g/t silver, and 1.18% copper over 2.72m. Mineralization was seen over a longer bulk-tonnage gold interval of 146.30m of 0.61 g/t AuEq starting at 30m depth.

NW20-02 (-45°/300°) was drilled to establish a mineralization vector. It also successfully intersected 13.85 g/t gold, 27.89 g/t silver, and 1.21% copper over 0.50m, but the shallow dip of the hole vectored out of consistent gold mineralization below 55m.

NW20-03 (-65°/300°) resulted in the longest mineralized interval of the three-holes drilled from the first pad. It intersected 103.3m of 0.76 g/t starting at 16m from surface. A high-grade interval of 20.75 g/t gold, 4.34 g/t silver, and 0.46% copper over 1.00m was contained within.

120m to the northeast, NW20-04 (-80°/300°) intersected 138.62m of 0.82 g/t AuEq. A higher-grade centre containing 33.57m of 2.47 g/t AuEq persisted, including 54.59 g/t gold, 135.00 g/t Ag, and 1.18% copper over 0.50m starting at 120m. This is the first 40m step-out into the NE Extension away from NW19-12, connecting a high-grade centre of 44.13m of 4.48 g/t AuEq, including 1.00m of 76.56 g/t gold, 11.54 g/t silver, and 0.47% copper. NW19-12 contained a total mineralized interval of 188.00m of 1.23 g/t AuEq.

160m to the northeast from NW20-04, previously reported NW20-09 intersected 8.85m of 31.09 g/t gold, 6.54 g/t silver, and 1.07% copper, marking the discovery of an intrusion-related vein system. Mineralization is open along strike (see Enduro October 21st, 2020).

The limited drilling activity completed prior to Enduro was focused on near-surface, high-grade gold. The continuity of this high-grade zone to the northeast is encouraging and remains open. The wider intervals of gold mineralization which have similarities to mineralization seen in the neighbouring Sulphurets Camp are early signs of gold - copper porphyry potential near the high-grade gold. Enduro's exploration strategy has resulted in the majority of drill holes completed by the Company to have ended in these broad, bulk-tonnage gold mineralization, with indications that mineralization may continue to significant depths.

Gold - Copper Porphyry Potential at McLymont:

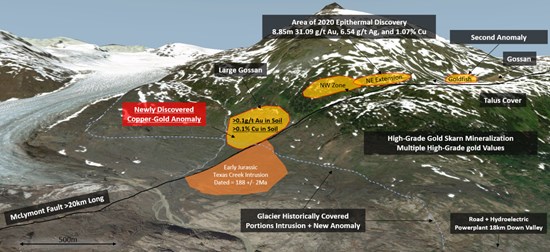

The Company has discovered the strongest gold - copper geochemical anomaly to date near the edge of a retreating glacier, immediately adjacent to the NW Zone and NE Extension. The anomaly consists of a 300m x 220m area averaging >0.1 g/t gold and >0.1% copper in the soil. An even larger gold anomaly of >0.05 g/t gold in soil spanning over 700m in length parallel to the McLymont Fault encompasses the entire area (see Figure 2 & 3).

Furthermore, recently amalgamated ZTEM geophysical data collected and inverted by Romios Gold Resources has identified a strong conductor extending to a minimum depth of 500m directly underneath the newly discovered gold and copper anomaly. Enduro now believes there is strong, geological, geochemical, and geophysical evidence for the presence of a large gold-copper porphyry system adjacent to the NW Zone gold skarn and NE Extension gold skarn/epithermal veining. The target has never been drilled.

Figure 2: 3D view of the McLymont Fault looking at the NW Zone, NE Extension, Goldfish, and the newly discovered anomaly near the glacier's historic edge. All targets are either sub-alpine or at valley bottom. The McLymont Fault targets sit 18km up the valley from an all-season road network connecting to Hwy 37, and a 303-megawatt hydroelectric power facility.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6406/74016_a3de70abe4aba87e_003full.jpg

"We are consistently intersecting shallow, high-grade gold and copper mineralization along our down-plunge target. Signs of increasing grade and continuity along trend are displayed by the 8.85m of 31.09 g/t gold, 6.54 g/t silver, and 1.07% copper in NW20-09, located 400m northeast from the original surface discovery. At this point, we do not know the limits of the system," commented Enduro CEO Cole Evans. "What is critical for shareholders to understand besides the high-grade intersections is the broader, bulk-tonnage gold intervals that have been intersected in numerous drill holes as we continue to explore. That is exactly what we want because ultimately near-surface high-grade gold mineralization in the Golden Triangle is commonly spatially associated with a porphyry deposit. Furthermore, porphyry deposits are rarely isolated events and often form in clusters."

"Figure 3 tells an important story. Mineralization is developing similar in style to deposits such as KSM, Iron-Cap, Snowfields, and Treaty Creek located 50km to the southeast. However, the Newmont Lake property has seen a small fraction of the exploration seen by those other deposits, and even our deepest drill holes to date would barely scratch the surface of a large porphyry deposit that are typically a kilometre or more in vertical extent. It's exciting to see the geophysics, geochemistry, alteration, structure, and geochronology all lining up consistent with what one may expect from a large porphyry deposit."

Figure 3: Plan view map of gold in soils with 3D ZTEM Inversion at 500m along the McLymont Fault. Grid spacing of samples is 50m x 50m. A 700m long >50ppb gold anomaly runs parallel to the fault. The strongest part of the anomaly is ~200m away from all historic and current drilling efforts to-date.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/6406/74016_a3de70abe4aba87e_004full.jpg

| Hole ID: | From (m) | To (m) | Interval (m) | Gold (g/t) | Silver (g/t) | Copper (%) | AuEq (g/t) |

| R-07-09 | 6.86 | 165.40 | 156.12 | 1.72 | 2.60 | 0.10 | 1.89 |

| 6.86 | 93.15 | 86.29 | 3.00 | 4.53 | 0.16 | 3.27 | |

| 15.24 | 16.76 | 1.52 | 29.60 | 11.40 | 0.36 | 30.22 | |

| 26.61 | 28.96 | 2.35 | 27.28 | 9.95 | 0.46 | 28.02 | |

| R-08-07 | 9.51 | 153.51 | 144.00 | 3.18 | 3.66 | 0.06 | 3.30 |

| (uncut) | 20.01 | 75.71 | 55.70 | 7.51 | 8.82 | 0.08 | 7.72 |

| 25.25 | 25.69 | 0.44 | 753.00 | 460.00 | 0.69 | 759.40 | |

| 75.71 | 153.51 | 78.91 | 0.49 | 0.32 | 0.04 | 0.55 | |

| NW20-01 | 30.20 | 176.50 | 146.30 | 0.50 | 0.97 | 0.07 | 0.61 |

| 68.15 | 73.00 | 4.85 | 10.35 | 15.93 | 0.73 | 11.52 | |

| 70.28 | 73.00 | 2.72 | 17.15 | 26.19 | 1.18 | 19.05 | |

| NW20-02 | 8.39 | 54.80 | 46.41 | 0.36 | 2.68 | 0.07 | 0.49 |

| (vectored | 15.00 | 15.50 | 0.50 | 13.85 | 27.89 | 1.21 | 15.81 |

| out of zone) | |||||||

| NW20-03 | 15.54 | 198.06 | 182.52 | 0.53 | 1.06 | 0.04 | 0.60 |

| 15.54 | 118.84 | 103.30 | 0.70 | 0.76 | 0.04 | 0.76 | |

| 55.07 | 56.07 | 1.00 | 20.75 | 4.34 | 0.46 | ||

| NW19-12 | 67.00 | 255.00 | 188.00 | 1.10 | 1.15 | 0.09 | 1.23 |

| 82.00 | 126.13 | 44.13 | 4.04 | 4.06 | 0.29 | 4.48 | |

| 111.35 | 112.35 | 1.00 | 76.56 | 11.54 | 0.47 | 77.33 | |

| NW19-17 | 80.24 | 81.74 | 1.50 | 9.33 | 16.29 | 0.82 | 10.63 |

| 189.00 | 207.31 | 18.31 | 1.80 | 0.37 | 0.04 | 1.86 | |

| NW20-04 | 43.80 | 276.70 | 232.90 | 0.46 | 1.63 | 0.05 | 0.55 |

| 115.60 | 254.22 | 138.62 | 0.70 | 1.21 | 0.08 | 0.82 | |

| 119.83 | 153.40 | 33.57 | 2.10 | 4.05 | 0.24 | 2.47 | |

| 119.83 | 120.33 | 0.50 | 54.59 | 135.00 | 1.18 | 57.78 | |

| NW20-09 | 144.12 | 172.46 | 28.34 | 10.03 | 2.31 | 0.36 | 10.54 |

| 159.88 | 168.73 | 8.85 | 31.09 | 6.54 | 1.07 | 32.61 | |

| 162.45 | 163.04 | 0.59 | 225.30 | 25.81 | 4.90 | 232.20 |

Table 1: Spatially highlighted assays to date displayed in Figure 1 in order from left to right. Metal prices used in AuEq calculations are as follows: Gold $1650/oz, Silver $19.50/oz, Copper $3.25/lb. The AuEq formula used for calculations is: AuEq g/t = (Au ppm * 100%) + (((Ag ppm * 0.63) * 100%) / 53.21) + (((Cu ppm * 0.007165029) * 100%) / 53.21) True widths are unknown as the mineralized body remains open and requires further drilling. Recoveries are assumed to be 100% for the purposes of equivalent calculations.

Texas Creek Intrusion

As part of a recent geochronology study completed by Dr. Kyle Larson at the University of British Columbia | Okanagan Campus, the Company has age-dated a monzonitic intrusion in the hanging wall of the McLymont Fault to be 188 +/- 2 Ma in age. This age is highly significant because it falls within the Early Jurassic 202 - 185 Ma time window and is very similar in composition to the famous Texas Creek Intrusive Suite - the rocks responsible for forming multiple deposits in the Golden Triangle including: Kerr - Sulphurets - Mitchell (KSM), Iron Cap, Snowfields, Treaty Creek, Brucejack, Snip, and Premier.

Figure 4: Slab sample of the monzonitic intrusion spatially associated with the NW Zone, NE Extension, and newly discovered anomaly along the McLymont Fault.

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/6406/74016_a3de70abe4aba87e_005full.jpg

QAQC / Analytical Procedures

Core samples from the Newmont Lake Project were sent to MSA LABS' preparation facility in Terrace, B.C., where samples were prepared using method PRP-910. Samples were dried, crushed to 2mm, split 250g and pulverized to 85% passing 75 microns. Prepped samples were sent to MSA LABS' analytical facility in Langley, B.C, where 50g pulps were analyzed for gold using method FAS-221 (fire assay-AAS finish). Gold assays greater than 100 g/t Au were automatically analyzed using FAS-425 (fire assay with a gravimetric finish). Rock samples were analyzed for 48 elements using method IMS-230, multi-element ICP-MS 4-acid digestion, ultra-trace level. Silver assay results greater than 100 g/t Ag and copper, lead, and zinc greater than 10,000ppm were automatically analyzed by ore grade method ICF-6.

Enduro Metals Corp. conducts its own QA/QC program where five standard reference material pulps, five blank reference material samples, and two field duplicates are inserted for every 100 samples when analyzing core samples.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Maurizio Napoli, P. Geo., Director for Enduro Metals, a Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About Enduro Metals

Enduro Metals is an exploration company focused on it's flagship Newmont Lake Project; a total 638km2 property located between Eskay Creek, Snip, and Galore Creek within the heart of northwestern British Columbia's Golden Triangle. Enduro entered into an option agreement to acquire 436km2 from Romios Gold Resources who has carefully amalgamated the area since 2005 from numerous smaller operators. Remaining terms on the option agreement are a $1,000,000 CAD cash payment, and issuance of 4 million Common Shares to Romios Gold Resources. Romios will retain a 2% Net Smelter Returns Royalty (an "NSR") on the Newmont Lake Project, or on any after-acquired claims within a 5 km radius of the original boundary of the project, which may be reduced at any time to a 1% NSR on the payment of $2 million per 0.5% NSR. The remaining 202km2 is owned 100% by Enduro and was acquired via staking or cash purchase. Building on prior results, the Company's geological team have outlined 4 deposit environments of interest across the Newmont Lake Project including high-grade epithermal/skarn gold along the McLymont Fault, copper-gold alkalic porphyry mineralization at Burgundy, high-grade epithermal/skarn silver/zinc at Cuba, and a large 9km x 4km geochemical anomaly hosting various gold, silver, copper, zinc, nickel, cobalt, and lead mineralization along the newly discovered Chachi Corridor.

On Behalf of the Board of Directors,

ENDURO METALS CORPORATION

"Cole Evans"

President/CEO

For further information please contact:

Investor Relations

Sean Kingsley - Director of Communications

Tel: +1 (604) 440-8474

Email: info@endurometals.com

https://www.endurometals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains statements that constitute "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation (collectively herein referred to as "forward-looking information"). Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Enduro's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking statements in this document includes statements, but is not limited to results, analyses and interpretations of exploration and drilling programs; our grassroots exploration program, our mining (including mining methods), expansion, exploration and development activities, geological and mineralization interpretations and the plans, results, costs, and timing thereof. Although Enduro believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by their nature forward-looking statements involve assumptions, known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions the effect of a pandemic and particularly the COVID-19 outbreak as a global pandemic on the Company's business, financial condition and results of operations and the impact of the COVID-19 outbreak on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, financial condition and results of operations; assumptions regarding expected capital costs, operating costs and expenditures, production schedules, economic returns and other projections; ; adverse industry events; future legislative and regulatory developments in the mining sector; the Company's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of Enduro to implement its business strategies; competition; and other assumptions, risks and uncertainties.

This list is not exhaustive of the factors that may affect any of our forward-looking information. Although we have attempted to identify important factors that could cause actual results, actions, events, conditions, performance, or achievements to differ materially from those contained in forward-looking information, there may be other factors that cause results, actions, events, conditions, performance, or achievements to differ from those anticipated, estimated or intended.

The forward-looking information contained in this news release represents the expectations of the company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

For US Investors

Enduro Metals cautions that this release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Information included in this media release have been prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (SEC) and information contained herein may not be comparable to similar information disclosed by U.S. companies.